TUESDAY 6/18 4-6 PM

12025 Townline Road

410 Opal Lane

3121 2nd Ave. W.

2711 2nd Ave. W.

Knowlegable Dependable Professional

We are seeing a late spring weather-wise, but activity on lake shore is starting much earlier than usual! Our office alone has closed on 4 nice lake homes already in 2019, we have 3 more under contract, and we have been out showing buyers many more. The ice is still on most lakes and the frost is definitely on the pumpkin some mornings, but the lake home market is hot!1 If you are thinking about selling this year, NOW is the time to be on the market before the buyers are gone! If you are hoping to buy lake property this year, NOW is the time to begin looking before before the best deals are gone!

Call one of our real estate professionals at 218-263-4411 for a list of available properties or for a free, no obligation market analysis on your lake shore today!!

Home financing translated into English that a normal person can understand…Part Five.

Thus far in our series about home financing options we have blogged about FHA, DVA, Conventional, and USDA loan options. (Go to johnsonhometownrealty.com to review any of these blogs…) Today we are taking a look at the 203K Home Improvement Loan program. These are definitely “niche” loans, but the borrower looking to buy and immediately remodel a property may find this to be an ideal option. As always, this blog is an effort to give you just enough information to make you aware that this program exists and to get you in to see a good, experienced lender who can answer all of your questions and to help you ascertain if the 203K program is the best answer for you.

The main “pros” that 203K loans offer include: No current equity is necessary, only a 3.5% down payment is required, the buyer ends up with one mortgage, one payment, and one deduction, and finally, the borrower can finance all desired home improvements as well as the replacement of any missing appliances such as a furnace, refrigerator etc.

The “cons” of these loans include: Do-it-yourself work is not allowed, borrowers must work with contractors for written bids, contractors must be vetted and approved by lenders, many lenders either do not understand or even offer these programs, loans are only available for primary residences (not open to investors), and more paperwork is generally involved and closing often takes longer than with other mortgages.

As has been discussed in this series of blogs, there are many different home mortgage programs available. Do not become confused and do not become intimidated. Work closely with a good lender, and find the financing option that works best for your situation!! Thanks very much to Julie Rigstad of Union Home Mortgage for her expertise and input for this blog.

Coming next, AEOA and KOOTASCA Homebuyer Assistance Programs…

Home financing translated into English that even a normal person can understand…Part Four.

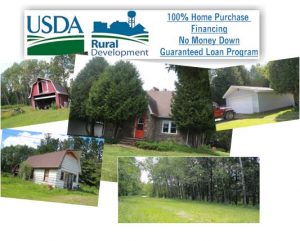

Over the past 3 weeks we have blogged about FHA, DVA, and Conventional financing options. We have tried to explain the basics of each of these loan programs, and what advantages and disadvantages each one offers. We have also emphasized the fact that a good, experienced lender is your best asset as you try to figure out which of these will work best for you. There is, however, another option, the USDA Rural Development Loan, that will work well for some buyers…

While “Top Secret” may be overstating it a little bit, this program is certainly the least known of the available mortgage choices. These are zero-down-payment mortgages guaranteed by the USDA for eligible rural and suburban home buyers. They are most often used by borrowers who are having trouble getting traditional funding.

The primary advantages of a USDA Rural Development loan are: No down payment, up to 6% seller concessions towards buyer closing costs, modular and manufactured homes may be eligible, and no lot size restrictions.

The main disadvantages include: Geographic restrictions (for example, property with a Hibbing zip code is NOT eligible), Mortgage insurance is required, there are certain income limits, and only single family, owner occupied homes are allowed.

As was stated earlier, there are many home loan options and much information to consider about each one. Don’t be intimidated!! Work closely with a good lender and find a program that suits your needs and fits your situation!! A big Thank You to Alyssa Amic Shega of Fairway Mortgage for her input on this subject…

Next up, Renovation Loans...

Home financing translated into English that even a normal person can comprehend…Part Three.

Over the past few days, we have blogged about FHA and DVA mortgages focusing on the basic advantages and disadvantages of each. A home buyer is well-served to have some idea about all of the different funding options and then to discuss those options with a lender who can guide them down the best path.

A conventional mortgage is a home loan that that is not insured or guaranteed by the federal government, as opposed to FHA, DVA and USDA mortgages which are backed by the feds. Nationwide, conventional loans are the most common type of home finance options.

The main benefits of conventional financing include: Loan fees can be negotiated, creative financing is an option, down payments can be as low as 3%, total closing costs are lower than with other options, mortgage insurance can be discontinued at a certain point, and the appraisal rules are more relaxed than they are with government backed loans.

The primary disadvantages of conventional financing are: Interest rates can be higher than FHA rates, and it is more difficult for a buyer with a lower credit score to qualify for a conventional loan. (Credit scores are the subject of a couple of future blogs.) The rule of thumb here is, “Conventional financing is tougher on the buyer and easier on the property.”

A buyer does not need to be a home loan expert before going in to meet with a lender, but having a little background about some of the terms and the main options will give him/her a definite “edge” when speaking with a mortgage broker.

Next up, USDA…

Last week we discussed FHA mortgages – What they are, what advantages they bring and what disadvantages are associated with them. As was mentioned in that blog, a home buyer needs to begin the purchasing process by finding a good Realtor and a good lender. The lender can then explain all of the options (and they are many), and help you ascertain which type of funding best fits your situation.

Our goal here is to give you just enough information about the types of financing available so that you will be a little more comfortable when you meet with your lender.

Everybody has heard of them, but what exactly are they? A VA (or DVA) loan is a mortgage guaranteed by the US Department of Veterans Affairs. This program is for American veterans, current military members, reservists, and some select surviving spouses. It can be used for just about any type of single family residential property, including new construction. The basic intention of the VA home loan program is to supply financing to help eligible veterans purchase a home without a down payment.

The main benefits of a VA loan include: Typically no down payment is needed; no Private Mortgage Insurance premiums (PMI) are required; buyers closing costs are limited; interest rates are often lower than with other loan types; and higher debt-to-income ratios are allowable.

The disadvantages of a VA loan are: A funding fee must be paid by the veteran (2.15% to 2.4% of the loan amount the first time the borrower uses his/her VA benefit and even higher thereafter), though this fee is typically financed or “rolled into” the loan; these loans are for owner-occupied property only, not for any type of income property, VA loans are difficult, if not impossible, to use for homes valued above a million dollars; and there is a perception among some sellers and some Realtors that VA loans are difficult to navigate and tough on the sellers. (While this last point was at least partially true in the past, it is mostly untrue today.)

In the vast majority of cases, an eligible veteran will find that taking advantage of the VA benefit he/she has earned is the best choice for home financing, however there may be some situations where another program may be more advantageous. Again, this is where a good loan originator can guide you through the choices and help you find the deal that is best for you.

Coming next, Conventional financing…

Home financing translated into English that a normal person can understand…

Getting a mortgage and financing a home can feel like an intimidating journey – The rules seem scary; the process appears to be lengthy; and the language used sounds Greek to most people. But it does not have to be frightening, long, or confusing. Take a couple of easy steps, and learn a couple of simple terms, and work with the right people and the whole deal can be quite painless!

The initial steps you need to take are these: 1) Find a good, honest, well-trained Realtor that you are comfortable working with. 2) Ask that Realtor for contact information for 3 or 4 lenders he or she recommends. And, 3) Sit down with the lender you choose and discuss your options.

Here is where it could become confusing – VA, FHA, Conventional, AEOA, Minnesota Housing, Rural Development, First Time Home Buyer, Fixed Rate, Variable Rate…..Just reading all this probably gives you a headache.

BUT, a good lender will be able to guide you, and over the next few days I intend to cover the basics behind the types of financing you are most likely to hear about from your lender so that you have just enough background to be comfortable.

First FHA…

The Federal Housing Administration (FHA) is an arm of the Department of Housing and Urban Development with the primary purpose of encouraging home ownership in the U.S. Major advantages of this type of financing are: A low down payment (3.5%); Buyers can often get approval even with thin credit or problems with credit history; and it is relatively easy to use gift money toward a down payment.

The major drawbacks of FHA are that mortgage insurance raises your monthly payments and often cannot ever be cancelled, and the rules an FHA appraiser must follow are more strict than on conventional loans. The rule of thumb is that the FHA is easier on the buyer and tougher on the home….

There are many factors to consider in choosing home financing that your lender can help you to navigate. FHA loans are not the best option for everyone or every situation, but they are perfect in many cases for many people.

Coming next, VA Loans…

A hearty and well deserved CONGRATULATIONS to Danielle Randa-Sauter on her recent election to our Range MLS Board as a Director for a two-year term!! Danielle is currently in her fourth year as a full time realtor and nearing the end of her first year as an agent and associate broker here at Johnson Hometown Realty. She will bring enthusiasm, professionalism, and real estate knowledge to the board and will represent us all very well. We thank members who have served in the past as well as the current board and welcome Danielle to her new position.

Johnson Hometown Realty

2402 1st Ave.

Hibbing, MN 55746

218-263-4411